How Europe Found Success In Build To Rent With Modular

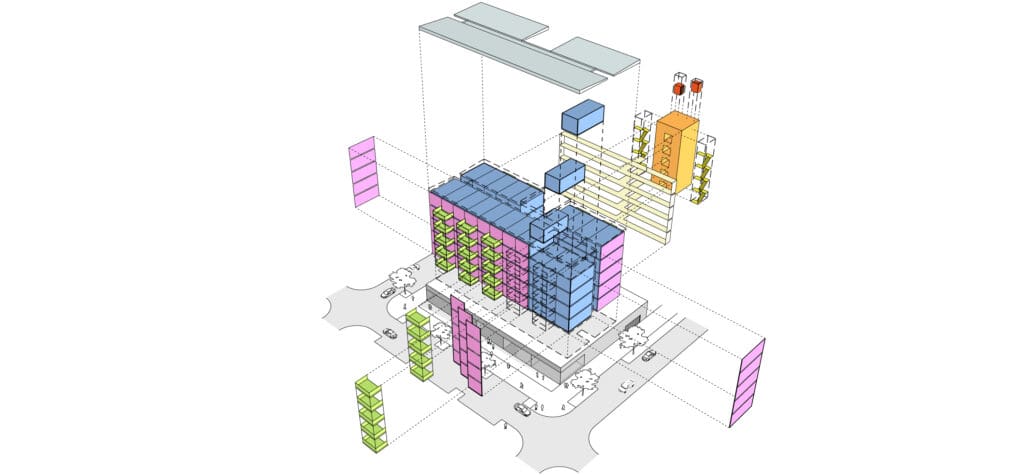

Above: Brunswick BTR concept design – street view.

As Australia’s population continues to increase in parallel with demand for inner-city living, the way we supply housing is shifting in an interesting way.

While past generations saw a house on a block of land as the ‘Australian dream’, for the new generation, an appreciation and acceptance of apartment living is fast emerging as the only way to live within proximity of the CBD. This has led to a slew of high-rises gradually taking over suburb after suburb, from Sydney’s Liverpool to Melbourne’s Moonee Ponds.

A new model of housing supply has also come to the fore – build to rent (BTR), sometimes referred to as multi-family living. The BTR model involves a developer, often with backing from an institution such as a superannuation fund, constructing a multi-residential project with the outlook of maintaining ownership and renting each apartment out – providing the owner with a steady, long-term passive income source. This sits in comparison to the traditional build to sell model in which a developer constructs a multi-residential project and sells each apartment for a short-term payoff.

BTR apartments are quickly becoming an attractive living arrangement for the younger generation who often prioritises lifestyle aspirations over homeownership, yet still craves security in living arrangements. It’s also appealing to those who can’t afford to buy (a significant portion of the under-35 market) and empty-nesters looking to downsize without the pressure of purchasing. BTR provides a more secure home for the renter, and a stable, long-term income for the owner.

A European success story

Long-established in Europe and a young, yet fast-growing model in the US and UK, BTR occupied an incredible 18% of Europe’s entire commercial market for 2020’s first quarter1, while in 2018, it saw an investment of more than £15 billion (AUD$27 billion) – more than double what it was at the same time last year2. In 2019, across half of the continent, BTR saw higher investment than offices, making it the preferred property investment sector for the first time3.

With the highest risk-adjusted returns4, BTR has the potential to morph from its current fledgling state into something comparative to its European counterpart. In fact, CBRE claims that Australia is one of the five markets around the world with the best potential for BTR success5. Taking this into account, together with widespread predictions of a looming housing shortage, it is no surprise then that the housing model is now finding some solid roots in Australia.

The last 12 months have seen interest in BTR explode, with estimates that 12,000 BTR homes across more than 30 projects are currently underway across Australia6, the majority occupying urban areas within Melbourne and Sydney.

So far, BTR developments in Australia have predominantly engaged traditional building methods. However it is significant to note that Europe’s market has seen success almost exclusively in partnership with modular construction. There are a number of advantages that come with modular for all sectors, and when married with the BTR model, these advantages equate to the biggest payoffs.

BTR and modular: a profitable pairing

Speed

Thanks to its off-site production and firm roots in design for manufacture and assembly (DfMA) principles, modular construction inherently produces a faster product, and therefore a faster and ultimately longer return on investment for BTR owners. By utilising modular construction, BTR apartments can be up and running – and generating income – months ahead of schedule when compared to traditional building methods, resulting in a higher overall return. In fact, recent research by McKinsey & Company estimates that the adoption of modular construction shortens project timelines by up to 50%7. For the developer, this acceleration also minimises the cost of loans through a reduction in interest payments, shaving significant costs off project overheads.

Cost savings

McKinsey also found that in the right environment, modular construction can cut build base costs by 20%7, particularly within projects that feature a degree of uniform repetition, such as multi-residential living. With repetition comes capital cost savings in prefabrication, resulting in a lower upfront price point for the developer. This repetition, combined with the high level of design documentation required for a modular build, also creates an unmatched optimisation as well as ease of extension of the building later down the track.

Less maintenance

Built to withstand transport and being lifted by a crane, modular builds are also hard-wearing, which equates to a property that requires less maintenance over its lifespan – a particularly important factor due to the long-term nature of the BTR income stream.

More sustainable

In addition, modular is the most sustainable way to build. Even more so when it is paired with DfMA, a design approach that focuses not only on the final product but also the ease in which it can be manufactured and assembled. By creating a product that is more streamlined, fits to standard sized materials and has ease of repeatability, it can be manufactured and assembled faster, more efficiently and with next to no waste. Modscape reports that for an average home, it creates only enough waste to fill an 8 cubic metre bin, compared to the traditional building model, which is widely reported to be one of the world’s biggest contributors to landfill. With a growing demand for sustainable and ‘green’ homes, the modular option suits not only the developer, but also caters to buyer demand, providing an additional ‘sell-point’ for the project complex.

In taking advantage of the benefits that come with modular construction, BTR may well be on the same path to the immense success that it has seen overseas. In fact, predictions note that BTR could evolve into a $300 billion industry8 in Australia, creating a new valuable asset class for investors, as well as a secure, long-term rental option for the new generation. As Australian governments and lawmakers take notes from overseas, the road to BTR success is being paved. However the choice on how to build is now in the hands of investors and developers, and that will dictate the sector’s future from here.

To discuss the benefits that modular could bring to your build to rent project, contact us today.

References

1 Mitsostergiou, E and Roberts, M, Spotlight: European Multifamily, Savills, 2020.

2 Barkham, R, Chin, H, Levy, S, Rice, J and Siebrits, J, Multifamily: Global Real Estate Market Outlook 2020 Midyear Review, CBRE, 2020.

3 Mitsostergiou, E and Roberts, M, Multifamily & co-living, Savills, 2019.

4 Martin-Henry, B and Speers, B, A taxing time for build-to-rent, CBRE, 2018.

5 Sweeney, N, Plenty of potential for build-to-rent but support needed, Australian Financial Review, 2020.

6 Tabet, T, Developer launches rent with option to buy model in Melbourne, The Urban Developer, 2020.

7 Bertram, B, Fuchs, S, Mischke, J, Palter, R, Strube G and Woetzel, J, Modular construction: from projects to products report, McKinsey, 2020.

8 Johanson, B, Build to rent: unlocking opportunity, Built Offsite, 2018.